SHIB Price Prediction: Can the 5800% Burn Rate Spark a Rebound?

#SHIB

- Technical Outlook: Oversold conditions may precede rebound, but MACD remains bearish

- Fundamental Catalyst: 5800% burn rate increase could reduce circulating supply

- Market Sentiment: Conflicted between anniversary optimism and investor fatigue

SHIB Price Prediction

SHIB Technical Analysis: Key Indicators to Watch

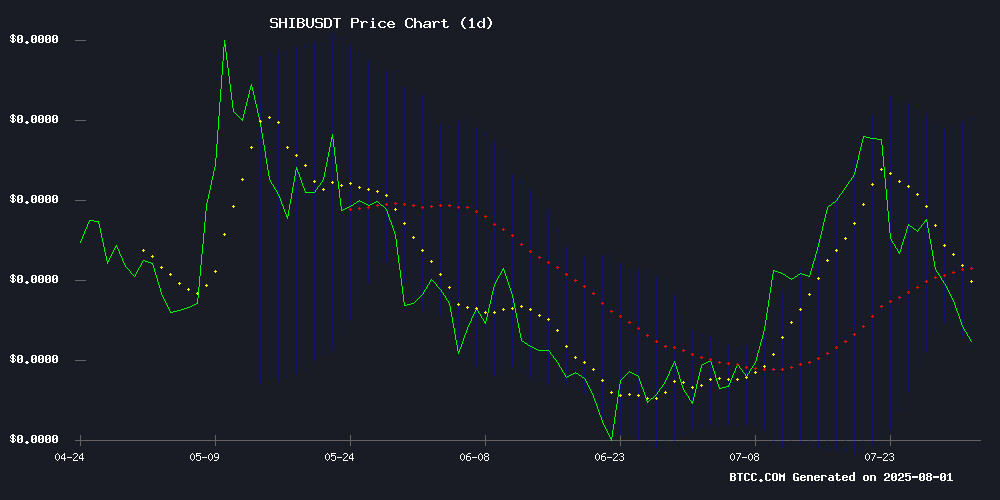

According to BTCC financial analyst Mia, SHIB's current price of 0.00001221 USDT is below its 20-day moving average (0.00001394), suggesting short-term bearish pressure. The MACD shows a slight bullish crossover (0.00000011), but remains in negative territory overall. Bollinger Bands indicate the price is NEAR the lower band (0.00001207), which could signal an oversold condition and potential rebound if buying interest returns.

SHIB Market Sentiment: Mixed Signals Amid Burn Rate Surge

BTCC's Mia notes conflicting signals in SHIB's news flow. While the 5800% burn rate increase (coinciding with Shiba Inu's 5th anniversary) suggests long-term supply reduction benefits, recent 21% price drop and declining new investor interest create near-term headwinds. The overextended RSI warns of continued downside risk, aligning with technical indicators showing bearish momentum.

Factors Influencing SHIB's Price

Shiba Inu Turns 5: $SHIB Burn Rate Increase 5800%, Rebound Ahead?

Shiba Inu marks its fifth anniversary with a staggering 5,800% surge in its token burn rate, sparking speculation of a potential price rebound. The meme coin has evolved beyond its origins, now backed by a robust global community and continuous innovation in the digital asset space.

The dramatic reduction in SHIB supply through accelerated burns could tighten market liquidity, historically a precursor to upward price movements. Market watchers are now scrutinizing whether this milestone will translate into sustained momentum for the Ethereum-based asset.

Shiba Inu Price Drops 21% Amid Declining New Investor Interest

Shiba Inu's price has plummeted 21% despite maintaining a high retention rate of 96%. The decline is primarily driven by a 40% drop in new addresses interacting with the token over the past 10 days, signaling waning confidence among potential investors.

The lack of fresh capital inflows has reduced buying pressure, creating uncertainty around SHIB's short-term price trajectory. Long-term holders appear unfazed, however, with the vast majority opting to retain their positions—a sign of enduring belief in the meme coin's future prospects.

Shiba Inu Price Faces Downside Risk as RSI Signals Overextension

Shiba Inu (SHIB) has tumbled 16% this week, with its Relative Strength Index flashing bearish signals amid a broader crypto market pullback. The meme coin now trades at $0.0000135, down 6% in 24 hours as smaller-cap peers suffer steeper losses.

Technical analysts diverge on SHIB's trajectory. CryptoELITES projects a 17x surge to $0.00023 if the token breaks a weekly symmetrical triangle, while Joe Swanson anticipates a 36% rebound based on a developing cup-and-handle pattern. Market participants await confirmation of either scenario as trading volumes spike.

How High Will SHIB Price Go?

Mia from BTCC provides this outlook for SHIB:

| Scenario | Target Price | Conditions |

|---|---|---|

| Bullish | 0.00001582 | Must break upper Bollinger Band with volume |

| Base Case | 0.00001394 | Reversion to 20-day MA |

| Bearish | 0.00001100 | Break below lower Bollinger Band |

The 5800% burn rate could provide fundamental support, but technicals suggest consolidation between 0.00001207-0.00001394 first.

0.00001582

0.00001394

0.00001100